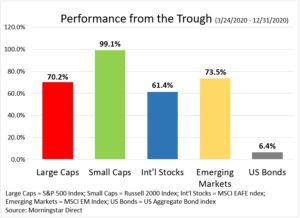

2021 begins in the shadow of one incredible year for many reasons! Who would have thought that 2020 would have finished with positive equity and bond market returns? Especially after the worst decline in 12 years which occurred at historic speed! From the trough of the decline, equity markets rebounded as if there was a rocket attached to them. The importance of the long-term could not have been more pertinent.

Breakneck declines can certainly challenge one’s muster. There was a silver lining of February–March 2020’s extremely quick decline. Many investors didn’t realize it happened. That statement sounds odd, but it’s true. Before many investors received their March statements, the rebound had already begun. Hence, due to the timing, near-term investor fearfulness did not work against investor longer-term objectives.

After nine months of incredible returns, behavioral finance (the study of psychology on investment decisions) would dictate a new psychological risk is in the making… recency bias. Recency bias is the concept that people most easily remember recent happenings. Within the context of investing, recency bias can cause investors to extrapolate recent performance into the future forming unreasonable expectations. In effect, recency bias can lead investors down a yellow bricked road mirage.

The body of academic investment research is based on rational thinking. The voluminous academics of Modern Portfolio Theory, Efficient Market Hypothesis or multivariate modeling are all based on logical deduction. Much of the research ignores basic fact that ultimately investment decisions are made by human beings. And, human beings are emotional creatures.

Here are a few tips to overcome recency bias.

- Recognize recency bias exists: The enemy can’t sneak up on you if you know it’s there.

- Retain a long-term view: The long-term will help you ignore the recent past (good or bad) and focus on the important things. Reviewing long-term objectives or financial plans can keep one on the right path.

- Control the controllable: Investors can control the asset allocation or stay away from investments that don’t adhere to their objectives. Take risk where appropriate.

- Don’t be swayed: Recent performance (exceptionally good or exceedingly bad) are temporary. This is why mean reversion is a tenet of our Capital Market Assumption research.

I hope that the year is off to a good start during these challenging times. Please stay safe and I hope the information above is helpful.

CRN-3408209-011521

Recent Comments