The financial markets began the fourth quarter with an enthusiastic rebound after a third quarter bottoming. Much of the rebound was a reaction to the low stock market valuations, less hawkish Federal Reserve (Fed) and perceived diminished uncertainty. Towards the end of the quarter, the Grinch decided a Santa Claus rally was not in the cards this year as markets gave back some of the earlier gains.

The financial markets began the fourth quarter with an enthusiastic rebound after a third quarter bottoming. Much of the rebound was a reaction to the low stock market valuations, less hawkish Federal Reserve (Fed) and perceived diminished uncertainty. Towards the end of the quarter, the Grinch decided a Santa Claus rally was not in the cards this year as markets gave back some of the earlier gains.

The positive fourth quarter broke the three-quarter losing streak. Much like 2022, the fourth quarter was filled with economic surprises, geopolitical shocks and COVID residuals, yet investors remain focused on the Fed. Rate hikes, Fed comments and directional guidance were scrutinized by investors, professional and amateur alike. Through 2022, the Fed remained flexible letting economic data drive the Fed’s inflation conquering decisions. The Fed’s shifting was often interpreted as a captain flying blind. During the year’s final quarter, the Fed was quick to soften its tone as inflationary pressures dissipated.

Consumer spending, which accounts for approximately 2/3rds of the economy, granted the Fed accommodations to hike rates during its quest to slay inflation. For much of the year, consumers spent their cash hoards bolstering inflation, yet strong economic activity via spending also gave the Fed an allowance for rate hikes. Consumer spending has waned in the final weeks dampening holiday expectations and will likely be accretive to inflation control.

Geopolitical entanglements were mostly ignored through the quarter. However, there are bubbling issues below the surface. China capitulated to COVID lockdown protests, yet China jailed protesters reminding them of China’s authoritative customs. Dissention is not tolerated. China is furthering their world view requiring Saudi Arabia and Russian energy purchases to be Chinese Yuan denominated, the latest chess-move to replace the U.S. Dollar as the world’s reserve currency. The Russia-Ukraine war seems to be at a tit-for-tat stalemate, which will continue to influence energy and food prices, especially for European nations.

The 2022 rout has removed speculative “investing” which tend to occur during the preceding loose and fast times. Specifically, many of the Special Purpose Acquisition Companies (SPACs) have called it quits returning cash to investors. Likewise, digital assets have come under pressure through the year and capped off with the bankruptcy of FTX and other digital asset purveyors in the fourth quarter.

INFLATION & RECESSION

INFLATION & RECESSION

The inflation peaked in June1 with pressures receding. Inflationary pressures can be bifurcated into two camps, supply-chain disruptions, and enduring pressures (such as energy, food, and policy). Supply-chain issues, stemming from the COVID restart, have mostly dissipated, or will soon be resolved. The more enduring aspects of inflation (energy stresses, food constraints and governmental policy) is of broader concern. Inflation’s downward trajectory is the desired path indicating early success of the Fed’s prescription, but enduring pressures may limit a

return to the pre-COVID inflation levels.

The Fed’s action is not without risk. Fed Chairman Powell cited likely economic “pain” during his August comments2, meaning the Fed’s action will likely result in recession. The fourth quarter witnessed a number of recession-impending indicators flashing red. These indicators tend to signal recession 3-12 months hence. However, year-long recession prognostications contributed to the difficult 2022 suggesting the financial markets have made significant adjustments in preparation for any economic weakness.

EQUITY MARKETS

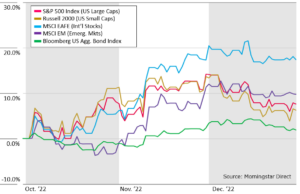

The equity markets shrugged off the doldrums of the third quarter with a Halloween/Thanksgiving rally in October and November. However, the typical Santa Claus rally did not materialize as the Grinch swept in to finish the year with a decline.

The Grinch was strong enough to remind investors we are not out of the woods yet, but not so strong as to extinguish the previous rally. International equities had the added tailwind of a falling US Dollar contributing to high double digit returns for the quarter. Positive quarterly stock market performance pared previous quarters’ declines, however 2022 was still the worst performing year since 2008.

Stock market valuations finished the year substantially lower than where they started. Valuations, as measured by the Price/Earnings Ratio (P/E Ratio), are below the 25-year historic averages among all major stock markets3. Low valuations portend low future expectations, suggesting limited downside and higher upside over time.

FIXED INCOME MARKETS

FIXED INCOME MARKETS

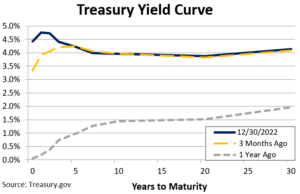

The fourth quarter bond markets continued to be influenced by the Fed’s actions. As the Fed softened its view of future rate hikes, bond investors gained clarity of impending economic “pain” suggested by Fed Chairman Powell2 months earlier. Aware of the increasing risk of recession, bond investors sought a flight to quality. Fed rate hikes and the flight to quality caused a yield curve inversion, a telltale sign of recession.

The higher demand for bonds translated into positive returns for the quarter. The positive bond returns buoyed bond performance, but not enough to clock in the worst annual bond performance in our lifetimes. The previous worst annual performance was -2.9% in 1994 as measured by the Bloomberg U.S. Aggregate Bond index4. 2022 was an unexpectedly historic year, just not the records we like to see.

Though pullbacks are a healthy part of the investing cycle, they are not pleasant to experience. 2022 is a year many of us would like to say good riddance. It could be said that 2021’s exuberance led to the conditions that resulted in a challenging 2022. Likewise, the 2022 blues could lay the conditions for the pendulum to swing in the other direction. Near-term volatility seems the de facto mindset, but we have come to learn many modifications can take place in a short period of time. Thank for the trust you have placed in us during this trying year.

1Bureau of Labor Statistics, 7/13/2022 2https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

3JPMorgan Asset Management, through 12/31/2022

4Morningstar, as of 12/31/2022

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. S&P 500 index measures the performance of 500 stocks generally considered representative of the overall market. Russell 2000 measures the performance of US small cap stocks. MSCI EAFE measures the performance of large and mid-caps of developed markets excluding the US and Canada. MSCI EM measures the performance of the large and mid-caps of emerging market equity securities. Bloomberg US Aggregate Bond index measures the performance of US investment grade bonds, including Treasuries, government agencies, corporates, MBS and ABS. CRN-5397884-010523

Recent Comments