Pause! The Federal Reserve (Fed) has teased a pause for much of the year. Finally, the much-anticipated Fed rate hike pause is here, at least according to financial market expectations. The latest Fed meeting (September 20th) delivered a measured tone and suggest the rate summit has been achieved. So, what now?

Financial markets’ returns tend to oscillate like a swinging pendulum. More drastic negative returns are often accompanied by higher positive returns and vice versa. Though we never know the market’s turning point, the market pendulum ultimately reverses course. Bond market swings are heavily influenced by interest rate changes. Bond prices are inversely related to interest rates. As rates rise, bond prices fall. As rates fall, bond prices rise. Further, as rates remain steady, bonds still generate positive returns through their yield.

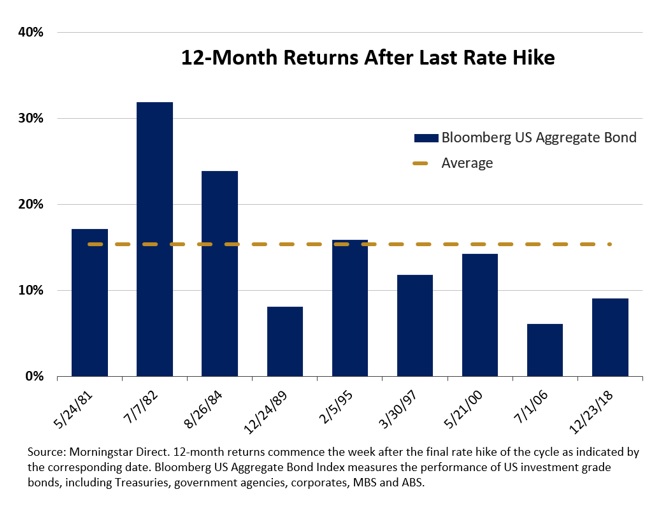

Since 1981, there have been nine Federal Reserve (Fed) induced rate hike cycles. In every case, bonds out-performed cash in the 12 months following the last rate hike. In most cases, bonds dramatically out-performed cash. This high consistency suggests there may be an underlying cause, which just happens to be the Fed.

The Federal Reserve has a dual mandate; price stability (i.e., low inflation) and maximum employment. These mandates are often juxtaposed to each other. The Fed’s primary tool of choice is interest rate control. If inflation (or the prospects of inflation) is too rich, raise rates; when the economy sputters, lower rates. Hence, the ebb and flow of interest rates. For background, yields and bond prices are inversely related. So rising rates are corrosive to bond returns, while lowering rates is accretive.

Fast forward to today, per Fed commentary and market expectations, the Fed’s rate hike cycle seems complete. The past 18 months of rate increases has threatened economic activity with recessionary markers flashing. Once the Fed feels high inflation has been conquered, the next step is to repair the economic damage created via lowering rates. Historically, rate cuts follow 3-8 months after the last rate hike. Lowering rates induce bond price gains. Such bond appreciation coupled together with bond coupons generate superior total returns to cash, which only offer yields as their only component of total return.

It’s important to keep in mind that cash equivalents reflect the Fed’s rate adjustments… on the upswing and the downswing. Yet, stable or falling rates are accretive to bond returns. It is tempting to bypass bonds for the stability of cash equivalents, but bear in mind bonds have historically offered a better risk/reward tradeoff. Cooler days and turning leaves signal the seasonal change just as peaking rates signal an investment dynamic change.

1US Department of the Treasury, treasury.gov

CRN-5965428-092023

Recent Comments