It happened again! In May 2020, Argentina defaulted for the ninth time in its history¹. The latest default tallies three occasions in the last 20 years. Good thing the Argentine Peso isn’t the de facto world currency.

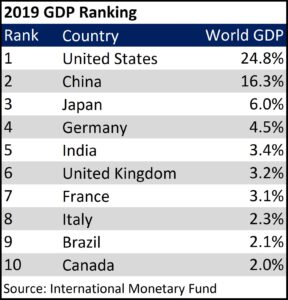

Interestingly, country defaults are more common that one might realize. Almost every country has defaulted, excepted for the U.S. For its nearly 250-year history, the U.S. has never defaulted on its debt². Return-of-capital, even through numerous wars and calamities, is one reason the U.S. dollar has become the de facto world currency. Additional reasons include the size and robustness of the U.S. economy, financial reporting transparency as well as leading in global finance and international affairs.

U.S. dollar importance is undisputable. The International Monetary Fund (IMF) claims 61% of the world’s cash reserves are in U.S. dollars. The Federal Reserve Bank of Chicago estimates that 80% of $100 bills are held outside the U.S. Worldwide commodities are priced in U.S. dollars. China and Japan each hold more than $1 Trillion U.S. Treasuries. The U.K. and Brazil hold $372 Billion and $283 Billion, respectively³.

The primary benefit of being the world’s reserve currency is that the U.S. can raise capital (i.e. borrow money by issuing Treasury bonds) more cheaply due to large purchases of Treasuries from foreign governments. Secondarily, the safe haven aspect means strong dollar during periods of uncertainty.

What does this mean for investors?

Lower borrowing costs (i.e. bond yields) and recent communications form the Federal Reserve means investors should be prepared for a prolonged low interest rate environment. Risk Free U.S. Treasury bonds yielding +5% are a product of the distant past. Investors, especially income-oriented investors, will need to look to different income sources and consider their risks carefully.

Low interest rates will make bonds more sensitive to interest rate changes. Exposure to various bond types and bond qualities are warranted. Bond investors should also become more aware of bond appreciation strategies, such as “Rolling Down the Curve” or active bond management.

Lastly, lower rates could support higher equity valuations. Yet, higher equity valuations make stocks more sensitive to price volatility. Additionally, as the clouds of uncertainty dissipates, the dollar’s value may decline, enhancing international investments. The importance of a well-diversified portfolio has never been more important.

CRN-3122368-061120

¹Bloomberg.com

²Bank of Canada’s Credit Rating Assessment Group

³US Treasury

Opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors. Forward looking statements may be subject to certain risks and uncertainties. Past performance does not guarantee future results. Actual results, performance, or achievements may differ materially from those expressed or implied. Diversification may help reduce, but cannot eliminate risk of investment losses. There is no guarantee that by assuming more risk, you will achieve higher returns. Investing involves risk, and investors may incur a profit or loss.

Recent Comments