Bond markets are often thought of as the most boring of the financial markets, but they are the most telling. Interest rates are at the heart of financial markets and economic relationships. Interest rates determine whether companies take on projects, roads/bridges are built, or consumers purchase products and services.

The most often quoted bond yield is the 10-year U.S. Treasury. This is the base rate for many forms of lending. The rate is near an all-time low at 0.70%, as of May 27th. In other words, the U.S. government will pay lenders annual interest of $0.70 on $100.00 for the next 10 years. A pittance. But Treasury bonds are considered “risk-free” as the U.S. Government has never defaulted, unlike almost every other country. (This is one reason the U.S. dollar is considered the world’s de facto currency.)

In addition to ultra-low yields, near-term maturities are lower than longer-term maturities. In bond parlance, this is referred to as an upward sloping yield curve. The yield curve is indicating an economic recovery in the near-term. The added ultra-low interest rates should buoy recovery efforts as well as assist with debt servicing, or the ability to make loan payments.

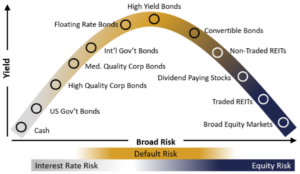

Non-Treasury bonds (corporate bonds, mortgage-backed bonds, etc.) pay higher yields than Treasury bonds as investors demand higher interest for accepting higher potential risk. Bond investors refer to this difference as “spread.” Analyzing spreads offer insight into the bond markets, equity markets and the overall economy. High spreads mean turbulence ahead, while low spreads mean smooth sailing.

Investors’ fear of the unknown during Feb.-Mar. caused bond spreads to swell widely. As COVID-19 mysteries were uncovered and the reopening of states and businesses commenced, the “unknown” became less daunting. In turn, most bond spreads have normalized. Many bond spreads are only slightly higher than the ten-year average. Like the yield curve, spreads are pointing to a near-term recovery.

Interestingly, asset-backed bond spreads (i.e. mortgage-backed bonds, automobile-backed bonds, credit card-backed bonds, etc.) have remained elevated. These bond market segments are communicating continuing default concerns. Should too many individuals remain without a job for too long, mortgage and car loan defaults could become a reality.

For investors, low yields translate to reduced income. Investors should be prepared to diversify how income is generated, while being mindful of the additional risk that may be included with convertible bonds, real estate, REITs, or stocks.

CRN-3105076-052820

Recent Comments