They got it wrong! The overwhelming number of investment professionals called for a recession to begin sometime in 2023 into early 2024. Yet, the recession never happened. This leads to the question, “How could so many experts be wrong?” A question that deserves to be answered.

Professionals of any vocation rely on data, observation, and interpretation to determine the next course of action. Economists, investment strategists, and financial analysts

utilize economic data and financial market indicators as tools for their trade. Those tools measure various facets of economic progression and how millions of investors interpret such data. Data come in two forms: hard data (undisputable figures, such as the number of employed individuals or cars sold) or soft data (surveys geared to capture the pulse of constituents, such as Unemployment Rate or Business Optimism).

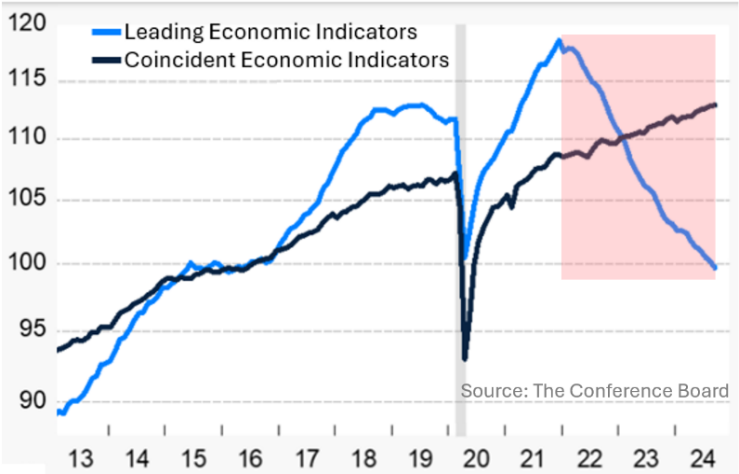

Each professional prefers their own set of tools and may develop bespoke measures. For argument’s sake, we will use indicators from The Conference Board. The Conference Board attempts to capture various data, boiling them down into easily digestible barometers. We will focus on The Conference Board’s Leading Economic Indicators (10 hard-data and soft-data measures) and Coincident Economic Indicators (four hard-data measures).

Generally, leading indicators and coincident indicators emulate each other. Leading indicators offer a peek into what is to come in the near future, while coincident indicators signal how things are going at present. Since early 2022, the two have diverged with leading indicators (what is to come) following a precipitous path downward as coincident indicators have continued their gradually advancing trajectory. This divergence has never happened in the history of The Conference Board measures.

Leading indicator inputs are the same or similar data utilized by investment professionals. It is clear the net interpretation was a forthcoming recession since early 2022. The economy not only survived, but it thrived per the coincident indicator gauge. This dichotomy will be the research of a future PhD, but the short answer for this divergence is cash availability. Recall that the federal government showered citizens with multiple bank-swelling rounds of cash, prompting a spending spree. It was this financial support that rendered just about every recession indicator (even those with 100% accuracy) ineffective.

The hordes of cash may have preempted a recession, but the price was higher inflation along the way and a tremendous debt burden. Such a national debt is not a today-or-tomorrow problem; it is a future problem for a future generation of politicians to solve. At the end of the day, there are three ways to overcome the debt issue: 1) tax more, 2) spend less, or 3) grow the economy. The experts might have gotten this one wrong. In their defense, no one could have anticipated the drastic game-changing fiscal measures rendering traditional tools and yardsticks useless.

CRN-7239202-102924

Recent Comments