Job-Wow! Last Friday’s employment report blew away forecasters expectations1 leaving economists scrambling to justify their errors and remain gainfully employed. Such an incredible report does beg investment professionals to comb through the report and weigh current environment dynamics.

Peeling back layers of the onion does show some interesting insights. The first observation was that most classifications added jobs except for a few sub-sectors such as Motor Vehicles and Parts, Utilities, and Technology2. Another interesting point is almost 40% came from added hospitality (i.e., restaurants), temporary office workers, and lower-level healthcare jobs (i.e., social assistance, continuing care facilities and doctor office assistance)2. A deeper dive shows many areas were skewed; for example, investment and real estate added personnel, swung the whole financial services sector into a net add2. In sum, the large addition of January jobs was highly influenced by lower-end jobs being filled. It was still a very good report, but the seemingly polished trophy may have some tarnished spots.

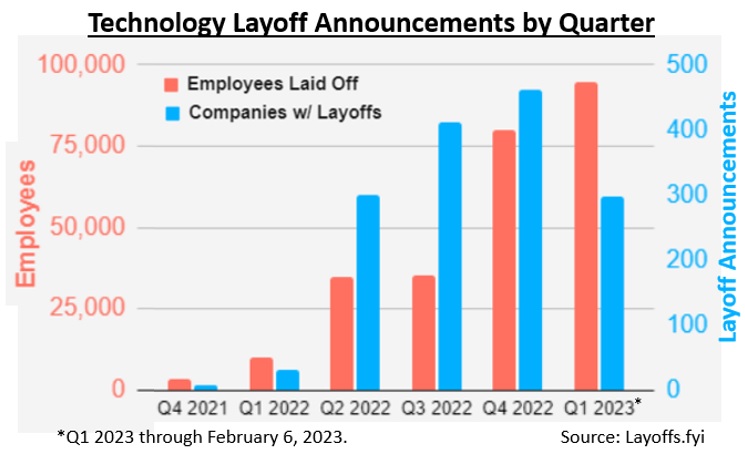

Layoff announcements have been picking up, especially with technology and white-collar workers. Layoff announcements are typically not immediate, but trail over the months following the announcement, creating a mismatch with the recently published January numbers. Hall-of Fame hockey player Wayne Gretzky is known for saying, “skate to where the puck is going, not where it has been.”

Further, the salary impact of layoffs may not be the same as hires. For example, according to the latest data (2021) from the Bureau of Labor Statistics’ Occupational Outlook Handbook, the average technology worker earns $97,430 vs the average restaurant worker earning $28,4003. In other words, it takes 3.4 restaurant workers to equal one tech worker. Recall a large part of the wonderful jobs report was lower paid workers.

Clearly the labor market is the shining star of the current business climate, yet the economy encompasses far more than working individuals. Other economic aspects have not fared as well. Monthly Retail Sales (about 2/3rds of the economy), industrial production and business investment have all softened4.

Jobs are an interesting aspect of our economy. Jobs are both an input to create goods/services as well as provide the means for people to purchase those goods/services. So, more jobs should translate to more goods and services transactions and buoy the economic downdraft being experienced in other economic facets. The latest employment report does offer hope of a softer landing or at least extending the recession event horizon.

You may have noticed the longer days. Although the cold days have not disappeared (at least in our area of the country), longer days do tease of warmer days ahead.

1“January’s Hiring Boom Caught Economists by Surprise. Why Forecasts Often Miss the Mark.” Wall Street Journal, Feb. 4, 2023

2Bureau of Labor Statistics, bls.gov

3https://www.bls.gov/ooh/

4St. Louis Regional Fed FRED Database

CRN-5459024-020923

Recent Comments