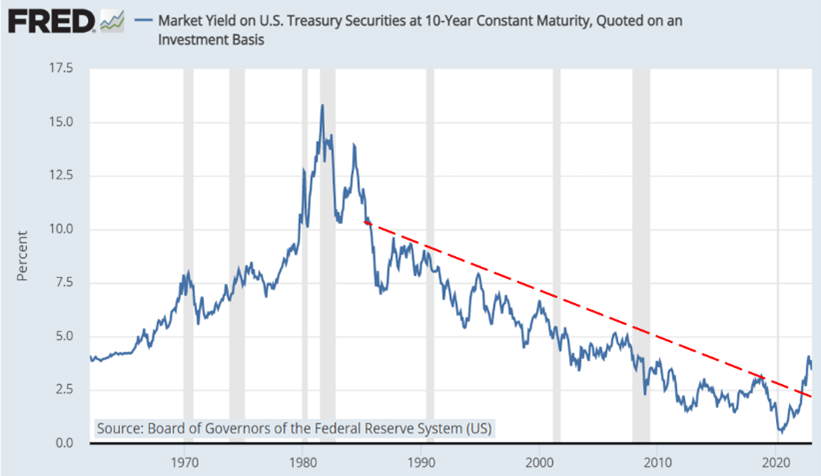

Interest rates had been falling for a short lifetime, about 40 years. Falling rates are directly accretive to bonds (as rates and bond prices are inversely related) as well as accretive to stocks as companies’ cost of capital declined boosting earnings and therefore stock values. The driver to falling interest rates was falling inflation. The inflation picture was a product of globalization, accelerating technological implementation and a large work force mainly due to the baby boomers.

Going forward, fixed income assets’ income component is likely to be more accretive than the past couple of decades yet accompanied with less bond appreciation potential. Higher yields also exhibit better downside protection characteristics due to lower duration or lower interest rate sensitivity. Hence, fixed income assets are likely to return to their more traditional role of stock market volatility diversification.

Equities are even more important going forward. Assuming the recent high inflationary numbers are behind us, equities have historically been the best long-term inflation hedge during moderate inflationary periods1. Why? The answer lies in pricing flexibility. By and large, companies change their product/service pricing on their input costs as well as the business environment to seek the highest profit/earnings. As their input costs (material, labor, transportation, etc.) rise, pricing increases to maintain profit margins and stay in business. Hence, as long-term inflation (i.e., input costs) rise, companies can increase their earnings. Since stock values are ultimately based on earnings, stocks rise over the long-term. (FYI, pricing constraints come from the economic environment and competition.)

Clearly, 2022 was not an enjoyable year. But going forward, a well-diversified portfolio with equities is generally the best avenue for long-term success. Equities are not a riskless panacea as we all know they come with short-term volatility. We may not be out of the woods yet, but a return to a more normal world seems to be around the corner.

CRN-5421082-011923

Recent Comments