First quarter earnings season has begun. The next few weeks will be filled with a parade of press releases, announcements, and guidance from corporate chieftains. At the end of the day, earnings, and profits drive stock values. The previous quarter’s reported profits allow investors to reconcile expected profits with actual profits.

Earnings announcements often accompany comments from the “C-Suite” executives, such as the Chief Executive Officer, or the Chief Financial Officer, etc. Remarks generally center around two aspects: 1) reasons for the previous quarter’s results, and 2) forward looking guidance. Insight can be garnered from each. The former may explain exogenous or endogenous influences causing positive or negative earnings surprises. These details are important to understand reaction to, say, bank failures (Silicon Valley Bank and Signature Bank) or marketing campaigns or consumer changes. This gives investors and analysts the opportunity to evaluate managements’ judgement.

Past is prologue. Though the former is important, it can be argued the latter is more valuable to investors as investing is a forward-looking endeavor. Corporate captains, responsible for piloting their ships, employ teams of experts to assess risks and spot opportunities. Monitoring forward guidance en masse may provide an understanding of what’s to come economically. For example, one company announcing layoffs may account for idiosyncratic risk, however layoffs from many companies across different industries alludes to broader systemic risk.

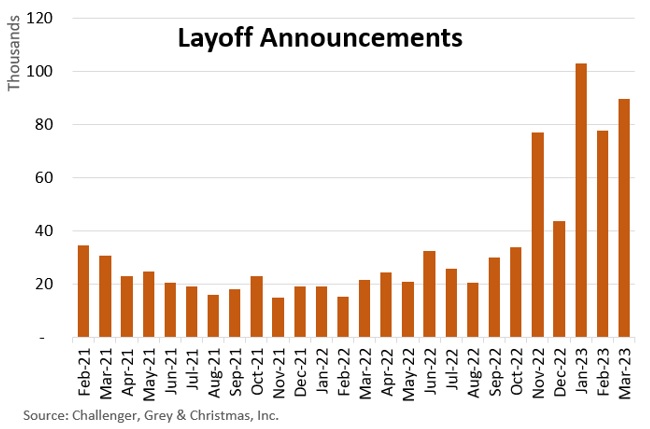

Speaking of layoffs, layoff announcements seem to have escaped much attention. A few layoff announcements have caught an article headline here and there, but aggregated announcements have mostly been ignored. Layoff announcements are often disregarded, even by professional investors, because announcements are simply announced intentions without concrete validation or noticeable headcount reduction. “Layoffs” from a corporate point of view could mean not filling positions, pulling job postings, shifting worker status as well as letting people go.

What’s the broader context of layoff announcements? The economy has evidenced deteriorating data and recessionary markers for months. Yet, labor markets have remained resilient during much of this time. The unemployment rate has remained very low; job openings have exceeded job seekers; and large payroll additions have continued for months. This has mostly been a function of a labor supply driven mismatch. Labor markets tend to be a confirmational indicator of the business cycle, but layoffs announcements have future intent making it a leading indicator labor market direction. Hence, labor markets may be seeing softer days ahead. Deteriorating labor markets could be the next indicator of economic weakness.

For those seeking employment, it may be a good idea to accept your next offer. If you’re thinking of moving on, it might be best to solidify your next step before quitting.

CRN-5651724-042723

Recent Comments