Jackson Hole, WY is a rustic locale reminiscent of the old west surrounded by steep mountain peaks with dude ranches and rugged campsites. Yet in an annual surreal juxtaposition, Jackson Hole becomes the center of the global financial system. The Federal Reserve Bank of Kansas City’s Economic Policy Symposium is one of the longest-standing central banking conferences in the world. The event brings together economists, financial market participants, academics, U.S. government representatives and news media to discuss long-term policy issues of mutual concern.

The Jackson Hole symposium is typically a confirmation of current conditions as well as pontification of economic outlooks. With investors’ constant vigilance, attention turns towards any grouping of central bankers to dissect words, phrases and even body language for insight of what may lay ahead.

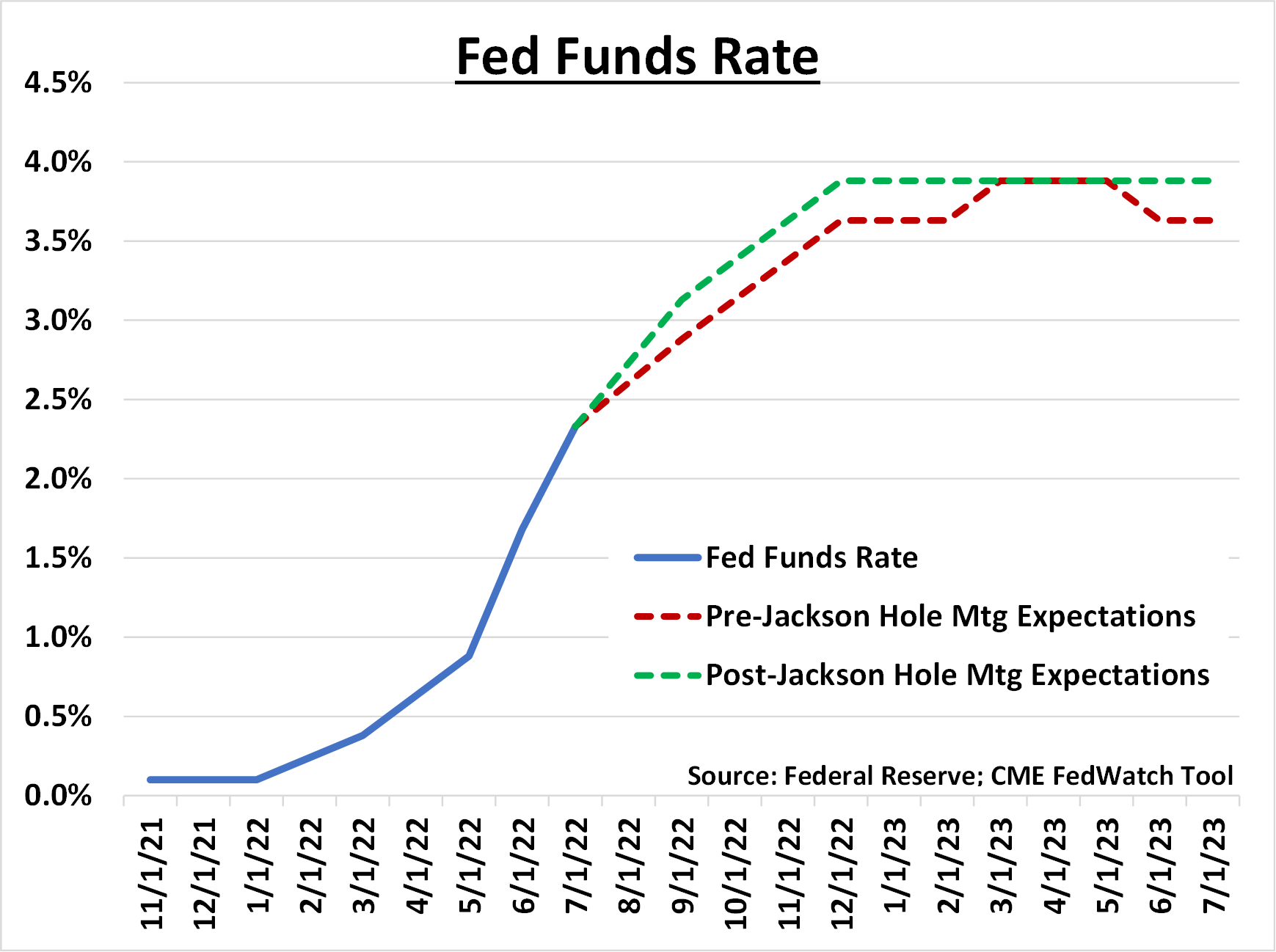

Last week concluded with one whammy of a revelation as central bankers prepared to check out of their hotel rooms. Fed Chairman Jerome Powell spoke for a brief 10 minutes with a far more hawkish tone than at previous press conferences. The dour tenor was accompanied by phrases such as, “higher interest rates… will also bring some pain to households and businesses,” and, “another unusually large increase could be appropriate at our next meeting,” and, “learned about inflation dynamics both from the high and volatile inflation of the 1970s and 1980s.”1 The markets quickly sold off and futures markets adjusted to the new directive. The Fed Funds Rate indicated a quicker pace to the projected terminal rate close to 4%2.

Comparing the pre and post expectations, raising rates a little faster seems almost de minimis. Yet in the world of corporate finance, 0.25% is very meaningful. Even further, the market expected rates to begin a lowering cycle mid-way through 2023. Chairman Powell’s comments altered expectations to suggest holding rates near 4% at least to the end of 20231. Powell also mentioned lessons from the ‘70s and ‘80s meaning holding rates high enough for long enough to break the back of inflation, even if this means inducing recession.

In summary, 1) inflation is high and seemingly stubborn, 2) the Fed will do what is necessary to curtail the inflation monster, and 3) economic pain (recession) is likely a byproduct as we press forward. Equities quickly digested the news with a decline while bonds adjusted to a new higher rate environment.

We are in the midst of our capital market assumptions review. We will incorporate the Fed’s view as well as other economic data and metrics, such as valuations and interest rate spreads, to determine what portfolio changes may be warranted.

1https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

2CME FedWatch Tool

CRN-4937349-090722

Recent Comments