Midterm elections are a few months away. Will the electorate’s political direction remain the same or change? By extension, how will the political landscape affect the financial markets? A historical review is by no means prognostication of the current year but could offer insight into what may lay ahead.

Midterm elections are a few months away. Will the electorate’s political direction remain the same or change? By extension, how will the political landscape affect the financial markets? A historical review is by no means prognostication of the current year but could offer insight into what may lay ahead.

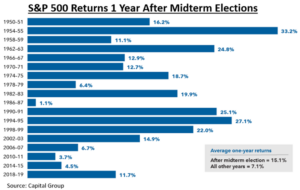

A recent study by analysts at the Capital Group (best known for their American Funds mutual fund offerings), indicates months leading up to midterm elections tend to display lackluster performance with heightened volatility. Yet, as election day draws closer, equities typically spring forward in an upward trajectory. These characteristics add credence to the idea that the stock market dislikes uncertainty.

The study has reviewed stock market performance following midterm elections since 1950. In every case, the 12 months following the midterms have produced positive returns, even during recessionary years. Astonishingly, the twelve months following the 1986 midterms squeaked out a 1.1% return even though it included October 1987’s stock market crash known as Black Monday, when the S&P 500 fell 20.5% in a single day1!

So, why do positive returns seem persistent after midterm elections? The answer lies in the removal of uncertainty. The midterms have clearly not favored one political party. Like the direction or not, the fact remains an election offers a political roadmap for the next couple years. This removes the uncertainty associated with the pre-election rambling and campaign positioning offering corporate chieftains a track to deploy company resources.

Three Possible Outcomes and Possible Policy Direction

| 1) | Republicans take the House and the Senate: | White House’s agenda is limited; focus on bipartisan efforts |

| 2) | Democrats retain the House and the Senate: | Democrats move forward with Build Back Better |

| 3) | Congress is split: | Curtail President’s agenda and tax/spend policies |

Candidates and the media can get us wrapped up in the politics of the day. Yet, financial markets monitor a much wider data set beyond those posed by Washington or a state’s governor’s office. It is fair to say financial markets tend to transcend political quarrels. Investors just need to know what lays ahead to establish financial models.

1spglobal.com

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp.

CRN-4915225-082322

Recent Comments