“In the short-term, the market is a voting machine, but in the long-term, the market is a weighing machine.” This quote is often credited to the godfather of value investing, Benjamin Graham; however, the true origin is unknown. It is a warning or message, depending on one’s point of view, of the market drivers. What matters in the long-term are the underlying fundamentals while the short-term is consumed with vacillating opinion of the fundamental’s expectations.

“In the short-term, the market is a voting machine, but in the long-term, the market is a weighing machine.” This quote is often credited to the godfather of value investing, Benjamin Graham; however, the true origin is unknown. It is a warning or message, depending on one’s point of view, of the market drivers. What matters in the long-term are the underlying fundamentals while the short-term is consumed with vacillating opinion of the fundamental’s expectations.

Opinions can be emotionally charged. Isn’t this why we are often warned not to speak of politics nor religion at the Thanksgiving table? Emotion stems from our primal brain physiology developed during the caveman days when a flood of hormones kept us alive or attracted a mate.

Fast forward to modern-day when the problem-solving frontal cortex is paramount. It is the frontal cortex which put a person on the moon or devised the internet to access knowledge instantaneously while ordering a pizza to be delivered at 6:30. Yet, the brain’s emotional limbic system’s constant tug, can distort reasoned thought. Former Federal Reserve Chairman Alan Greenspan famously mentioned investors’ “irrational exuberance” during the late ‘90s investing environment.

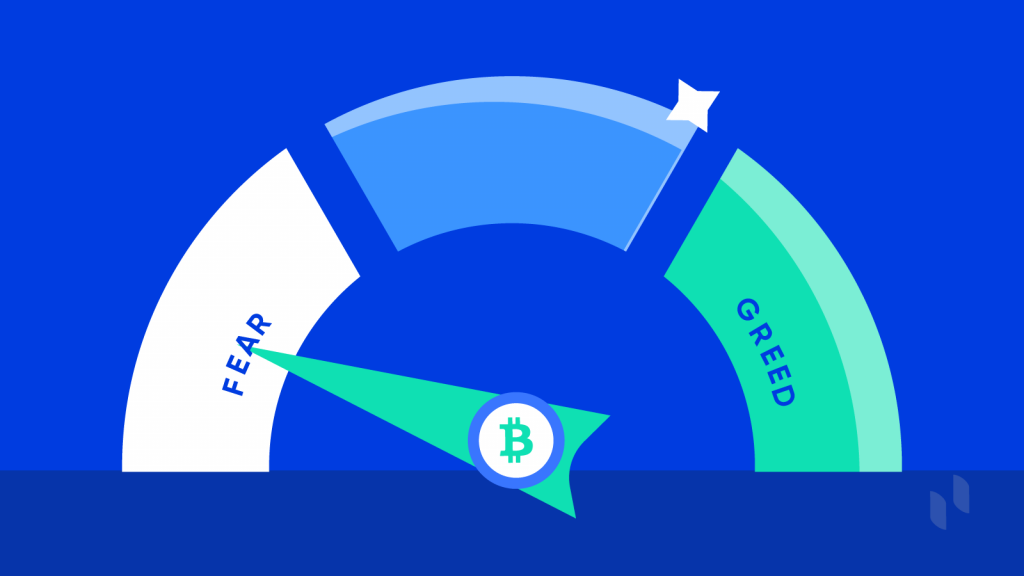

Over the years, various gauges have been devised to capture the influence of investor emotions. Of note is the CNN Business Fear & Greed Index. “The Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced.1” The theory surmises emotions tend to drive the market in the short-term to extremes. Extremes can often be reflective of an inflection point due to capitulation.

The Fear & Greed Index is used to gauge the mood of the market. Many investors are emotional and reactionary, and fear and greed sentiment indicators can alert investors to their own emotions and biases that can influence their decisions. When combined with fundamentals and other analytical tools, the Index can be a helpful way to assess market sentiment.1

A recent reading of the Fear & Greed Index is pointing to Extreme Fear. Fear can informally be defined as False Evidence Appearing Real. The volatility alone can be enough to rev up your emotional brain, yet likely does not affect your longer-term objectives. In short, investors are getting so emotionally wrapped up with wavering prognostications that they have forgotten to fairly assess the long-term fundamentals.

During emotionally volatile times such as these, it is best not to make any hasty moves. The best way to get through volatile times is to have developed a well-diversified long-term strategy, stick with it, and periodically rebalance. Any changes should be reflective of objective changes and not mood shifts. As always, reach out if you want to discuss the markets or have questions on your portfolio.

CRN-4744138-051622

Recent Comments