With the commencement of a new school year, an assessment of the U.S. financial education seems apropos. Sadly, U.S. financial education gets an F!

A recent study on financial education has shown the U.S. is derelict in its financial teaching responsibilities. Not long ago, financial basics were taught in school. Savings vs spending, paying bills, and earning interest were part of the curriculum. Unfortunately, these basic financial tenets are no longer taught in schools leaving individuals ill prepared for adulthood.

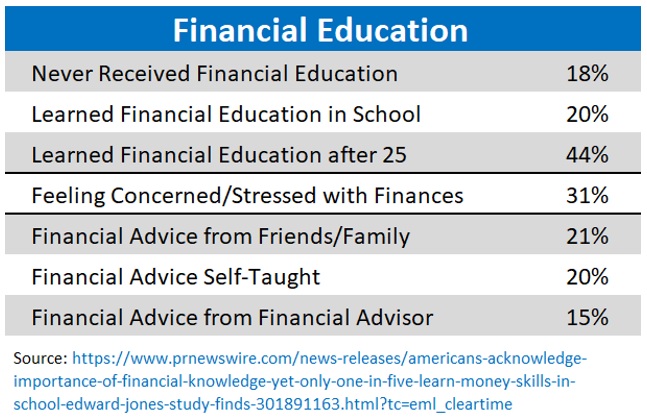

The recent study found that a scant 20% received any financial education in school with 18% never receiving any financial education1. The negligible percentage that has sought assistance from a financial advisor should be commended. Yet, that leaves the majority of the populace left to learn from friends and family or to fend for themselves. It should be of no wonder that a third of the survey respondents are concerned or stressed about their finances1. Remarkably it is not higher.

The U.S. Department of Education could do more than promote the 3 “Rs;” Reading, wRiting and aRithmetic. The Department of Education could and should establish a required high school semester of basic financial education to include importance of checking/savings accounts, bill paying, job income vs interest income vs capital gains, compound interest, general taxation and what it supports, and the purpose and benefits of Social Security. Further, the Department of Education could promote an optional semester geared toward investing, time-in-the-market versus timing-the-market, and diversification benefits. Such a simple measure would go a long way to give people the basics to survive in the 21st century and demystify money and its uses.

Unfortunately, the media fans the flames. The media, often obsessed with an audience instead of disseminating information, focuses on a stock, a trend or economic flash point. Fair enough. It’s sexier to talk about artificial intelligence (AI), alternative energy or crypto currencies versus living below your means or the wonders of compound growth/interest. Oddly, the media often does a disservice as their talking points unduly inflate prices leaving investors with empty promises.

Working with a financial advisor is a step in the right direction. Financial advisors are committed to staying apprised of mundane planning related topics (risk management, estate planning & tax reduction strategies) as well as the spicier subjects such as market changes, economic transition, and evolving trends. Financial planning can help develop a holistic wealth strategy and ease media distraction.

If you are working with a financial advisor, congratulate yourself. Going at it alone in this topsy turvy world with ever changing dynamics can be very stressful. You can help alleviate family member stress as well as help your families’ financial success by introducing your children and grandchildren to a financial advisor since the schools have clearly failed.

Recent Comments