Investing vs trading… it is often difficult to tell the difference. This is especially true when dealing with the financial markets. Merriam-Webster defines investing as, “to commit (money) in order to earn a financial return.” All dictionaries deliver the similar opaqueness, but we’ll try to offer a more distinguishable contrast.

Investing involves a broader and deeper knowledge of an asset. We often refer to this as due diligence. Trading, on the other hand, is less concerned with an asset’s fundamentals and is more concerned with the transaction flow. More practically, if a person is engaged in careful analysis of a company’s financial statements, competitive environment, business situation and economic assessment; that person is clearly applying investing principles. If a person is focusing on the ebb and flow of buys/sells, trade volume or data derived from either, that person is engaged in trading and often does not care about the company.

So, why is this important? The answer lays in knowing which is influencing the price of an asset at any given time. Day-to-day stock price movements are generally heavily influenced by traders. Longer-term appreciation/depreciation is generally governed by investors.

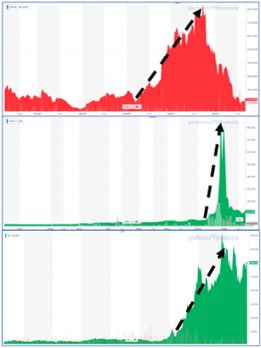

“I’ll know it when I see it.” Here are a few charts from Finance.Yahoo.com to demonstrate when your guard should be up. The stocks are irrelevant, but the charting isn’t. The similar trait is the hyperbolic direction. When stock prices seem to launch for the moon, the stock is clearly being governed by traders, people who are simply trying to profit from stock price movement. Unaware investors can easily get caught up in the frenzy and want to jump on the trend in a Fear of Missing Out (FOMO). Keep in mind, traders are primarily focused on a quick profit oblivious or unconcerned of their wake.

More recently, traders have taken to a new venue to amplify stock prices. This trend has been termed “meme stocks.” Also, from Merriam-Webster, meme is defined as, “an amusing or interesting item or genre of items that is spread widely online especially through social media.” In other words, traders have taken to “discussing” stocks online in order to generate interest and inflate stocks they typically own. Subsequently, they sell when the price is high pocketing a profit. With profit in-hand, chatter dries up often returning the stock to previous levels. This is the modern equivalent of illegal pump-and-dump schemes. Investors beware of the meme chatter.

It is tempting to want to make a quick buck, yet it’s important to conduct a fair due diligence and not be taken by meme stock movements. Whenever you see a stock price shoot for the sky, it is best to stay far away. “Know what you own” is an old and wise truism.

CRN-4968892-092722

Recent Comments