Last interest rate hike… for the year! The Federal Reserve (Fed) met for their final 2022 meeting and decided on the 0.50% increase as previously communicated. Subject to extemporaneous data, Fed Chairman Jerome Powell has generally stuck to his promised rate path over the past nine months, which held true for the Fed’s final meeting of 2022.

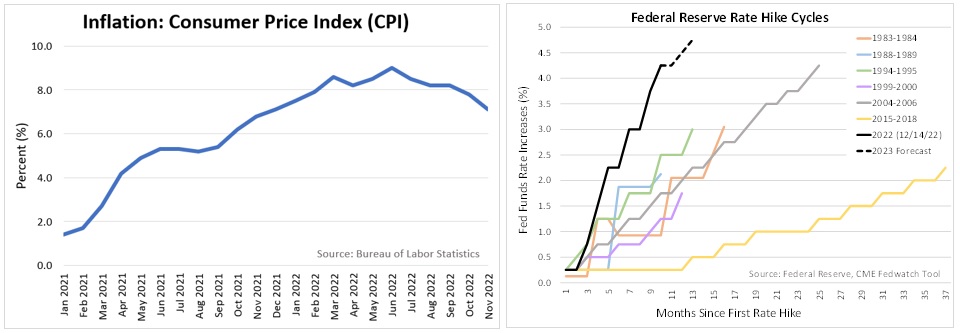

The data driven decision is a direct result of inflation’s path over the second half of the year. Inflation peaked in June with a clear and delineated path downward since. The most recent reading, delivered December 13th, came in well below expectations, which is a good thing. Inflation’s retreat in most categories contributed to the continued broad inflation downtrend1.

The prescription to inflation has always been higher interest rates. This is as well-known in economics as the sun rising in the East. Also known is the lag time for rate hikes to be effective. Well, after 9 months of rate hikes, it is clear the prescription has worked again. Yes, it comes with economic pain, but the pain of elevated or higher inflation would have been far worse. It’s either a little medicine now or a ton later.

Some of the economic pain has not fully transpired. Many measures suggest recession is on the way. Have no fear, recessions are a normal aspect of the economic cycle. Think of running or biking, at some point you need to rest and replenish fluids before your next jaunt. Recessions are just that, an economic rest. (More about this in future insights.)

The latest rate hike has been the most progressive in modern history in terms of the pace and levels. The Fed has communicated a rate hike pause in the near future. Investors have interpreted that to mean one or two more 0.25% rate increases2. If the Fed raises rates at its next two meetings, history will be made with the highest and quickest pace in the past 40 years.

As this rate hike cycle seems to be coming to an end, the Fed may be able to take a pseudo victory lap. “Pseudo” in that the sought-after soft landing may be a little harder than desired, but the long-term pain from sustained elevated inflation seems to have been averted. Please enjoy your final weeks in 2022.

1Bureau of Labor Statistics

2CME Group FedWatch Tool

Statements, opinions and forecasts made represent a particular observation and assessment of the market environment at a specific point in time and are not intended to be a forecast of future events, investment advice or a guarantee of future results.

CRN-5354954-121522

Recent Comments