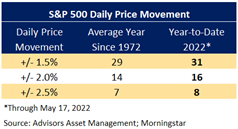

It is not news to anyone that the markets have been extremely volatile this year. The S&P 500 has closed either up or down by at least 1.5% for 31 days since the year has begun, surpassing the average number of 1.5% days over the past 50 years. Additionally, over 50% of the S&P 500’s members are off at least 20% from their all-time highs*, putting them in bear market territory. So, what is the prudent investor to do in such an environment? We believe the answer is the stay the course. Wealth-based investment portfolios are created during the good times in order not to panic during the hard times.

There is always going to be some “reason” to sell or to stay on the sidelines. Yet, examining some statistics may demonstrate there is far more to be lost from letting uncertainty keep you out of the market, than by staying in.

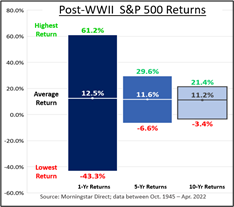

One of investors’ greatest assets is time. To show just how powerful an investor’s time in the market can be, we calculated Post-World War II rolling period returns for the S&P 500. The second chart shows the wide range of returns for 1-year periods and significantly narrower range of returns for the 5-year and 10-year periods. Yet, notice the average returns are rather consistent. Hence, the short-term is riskier (and more random) than the longer-term which is why wealth-based portfolios are based on longer-term investment horizons. Elongating one’s horizon also helps get passed the corrections and bear markets when they occur.

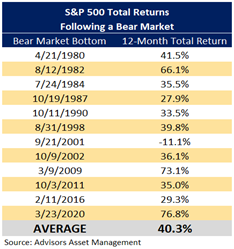

One last table on timing the market, and why following your investment plan is so important. The third table shows the past 12 bear markets. History has shown investors tend to sell after a decline missing the potentially large subsequent rally. Therefore, it is so important to stay invested; even when times are rough. We create investment portfolios when times are good so that we have a roadmap when times turn bad.

No one can predict every bad market outcome, but a disciplined investing approach reduces the biggest risk of all… guessing at the unpredictable market tops and bottoms. At the end of the day, investing plans should consider the potential for market downturns, long-term allocations, regular re-balancing, and proper investment horizons.

*Advisors Asset Management Analytics. The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index. The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

CRN-4758943-052422

Recent Comments