“Richcession” is the latest term creative wordsmiths have assigned the latest economic quandary. Recent corporate announcements have announced pending layoffs. Generally, these layoffs have hit technology workers and middle management folks, leaving frontline workers untouched.

Juxtaposed to typical recessionary environments, slowing economic activity typically hits lower-level employees. Yet this go around, not only are lower-level employees not being laid off, there has been a hiring spree. Have you noticed new restaurant wait staff, new barbers, new retail or grocery clerks at venues you frequent? The recent employment data was off the charts good with 517,000 jobs added1. This was one surprise data point. Overall, high employment data is a positive as more people are contributing to the economy; but there are repercussions for investors.

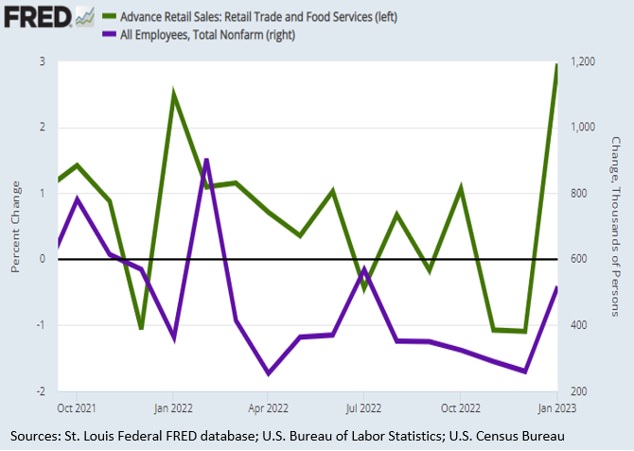

Another recent surprise data point was Retail Sales. Consumers are about 2/3rds of the economy, so monitoring their spending habits can reveal an awful lot about the economy’s direction. January’s Retail Sales was also fantastic, easily surpassing estimates2. January’s surprise came after four monthly contractions in the back half of 2022, with fairly deep contractions in November and December. Like the jobs’ numbers, this is good for the overall economy, but could have repercussions for investors.

Over the past thirteen months, financial markets have focused on Federal Reserve (Fed) action and comments. Coming into 2023, Fed Chairman Jerome Powell remarked of an interest rate hike pause. As the year began, the markets priced in two 0.25% increased with a pause after the second Fed meeting on March 22nd. In light of the recent surprising data points, financial markets have priced in at least a third 0.25% increase at the June 14th Fed meeting3.

Now to the impact on investors. Higher rates translate to further near-term volatility as higher interest rates, even 0.25%, places pressure on the overall economy, corporate earnings and bond valuations. This is not likely to resemble the volatility of 2022 when interest rates were increased 4.25% from near 0% in a quick nine-month period4. However, the added uncertainty could hold equities back until a clearer view appears.

From an economic standpoint, the surprise data could lead to a better economic outcome, maybe a soft or supple landing instead of a hard landing. We will continue to monitor the economic and market forces as they present themselves and share our thoughts.

1U.S. Bureau of Labor Statistics

2U.S. Census Bureau

3CME Fedwatch Tool

4Federal Reserve

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp.

CRN-5481116-022323

Recent Comments