On December 29, 2022, the SECURE ACT 2.0 was signed into law. Eric Wyss, Director of Financial Planning & Risk Management, has reviewed the pertinent sections to share the items that we feel are the most important and/or timely.

As of January 1, 2023:

- Required Minimum Distribution (RMD) Age Increased to 73

However, this only applies to clients turning 72 in 2023 or later. If you were already taking required distributions, you will continue with that same schedule.

- If you are eligible for delaying until age 73, we should still discuss whether delaying is appropriate for your household circumstances. Charitable gifting, marginal tax rates and cash flow are all a part of the decision to delay or not.

- Note: the age is increased to 75 in 2033, but that information requires no action.

- Matching for Roth accounts

Employers will be able to provide employees the option of receiving vested matching contributions to Roth accounts. Previously, matching could only be completed in a pre-tax contribution.

- If you decide to receive the company match in a Roth account, tax will be due for that employer contribution for the year of the match.

- Each household must decide whether paying taxes in the current year for tax free growth outweighs tax deferral and future taxation.

- Failure to take necessary RMD Penalty Reduced to 25%.

- Expanded rules for accessing retirement funds without 10% penalty.

Even if this rule applies to your household, removal of the penalty doesn’t remove the taxation of withdrawals and we should still discuss your options when you are making decisions on how to fund expenses and goals.

As of January 1, 2024:

- 529 Plan to Roth IRA Transfer

Some clients may have the opportunity to roll the remaining proceeds of a 529 plan into a Roth IRA. There are substantial limitations on this capability.- After 15 years, for the beneficiary, subject to annual Roth contribution limits and an aggregate lifetime limit of $35,000. Other limits also apply.

- This may be a good opportunity to establish a tax-free Roth account for the beneficiary with a likely long investment horizon.

- Higher catch-up limit for Regular IRAs

The $1,000 catch up provision will be indexed for inflation. - Qualified Charitable Distributions indexed for Inflation

- Also, a one-time opportunity to fund a Charitable entity with up to $50,000/spouse.

- Involuntary Roth Catch-up Contributions

Starting in 2024, taxpayers over 50 whose “wages” exceed $145,000 in the previous year will automatically have their catch-ups deposited in a Roth 401k (meaning they will be subject to taxation on the catch-up portion without the ability to choose deferral) - Surviving Spouse New Option

Surviving spouse can be treated as the original owner (deceased). In the case of a much younger spouse pre-deceasing the older, now the older spouse can elect to defer RMDs until the age the deceased would have begun.- Example: A 70-year-old survivor of a deceased 60-year-old spouse can wait 13 years if he elects to be the owner instead of the current 3 years (age 73).

Starting January 1, 2025

Higher catch-up limits in retirement plans to apply at age 60, 61, 62, and 63

SECURE 2.0 increases these limits to the greater of $10,000 or 50 percent more than the regular catch-up amount in 2025 for individuals who have attained ages 60, 61, 62 and 63. The increased amounts are indexed for inflation after 2025.

The changes put in place by the SECURE ACT 2.0 are meant to improve the retirement funding for ordinary Americans. However, every household has its own circumstances and before you make any decisions, we should discuss the best options for your household.

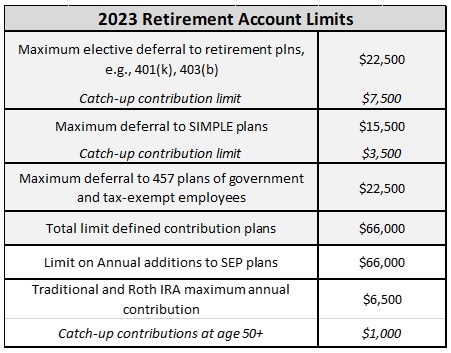

2023 contribution limits to employer plans have been increased and, in some cases, substantially. The table below shows the values available in tax year 2023:

CRN-5405674-011023

Recent Comments