This past weekend’s annual American ritual, the Big Game, had some spectators rejoicing in delight and others riling in disbelief. Prior to the game, the Eagles were a 1.5-point favorite suggesting a tight game. Unlike past lopsided victories, the Big Game delivered back-and-forth entertainment for everyone.

In recent years, the popularity of sports betting has taken off. Though betting is far from the investing field, they both utilize statistics and mathematics. I know… who wants to hear about math?!? Don’t worry, no hard math here, just food for thought about how returns ultimately affect portfolio values.

Returns are a peculiar thing. Oddly, typical 1+1=2 math need not apply. Portfolio architects need to be aware, if not well steeped, how serial returns, or returns from one period to the next, ultimately affect portfolio values. It seems logical that simply summing returns is all that is needed. However, simple summation would ignore compounding effects, how returns from one period to the next impact a portfolio.

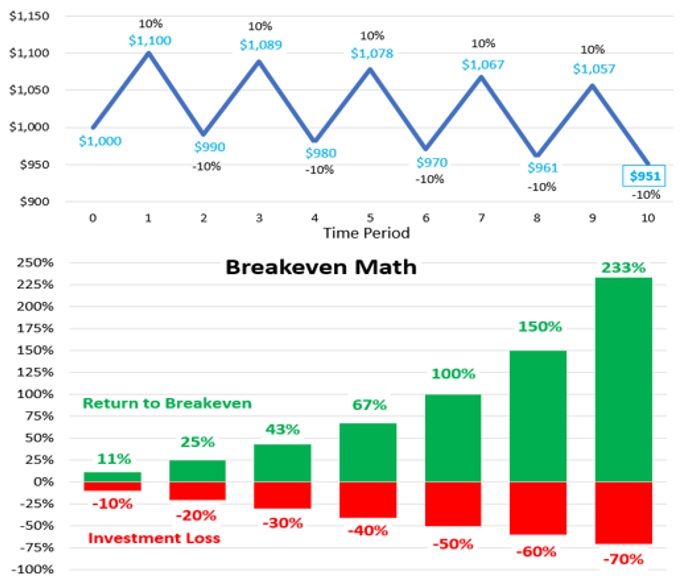

Let’s review an example that oscillates between a positive 10% return and a negative -10% return. Starting with $1000, logic would dictate summing 10 years of such returns would end up with the same $1000. Logic would suggest a gain of $100 in the positive years and a decline of $100 in the negative years. The reality is quite different. After 10 years, the investor would end up with $951! In such a scenario, the negative -10% has a more deleterious impact than the beneficial impact of the positive 10%. It seems odd, but it’s true.

What does this have to do with investing? In short, when developing a portfolio for the long-term, a portfolio architect needs to be aware of short-term return compounding affects. More importantly, the farther the decline, the more that is required to breakeven. Should a portfolio decline 10%, a subsequent 11% would be required to breakeven. Throttle that up to a -30% decline and a 43% return would be needed to breakeven. A -50% return would require a 100% return to breakeven. You get the point. So, portfolio architects should not just focus on average returns, but also the range of possible returns, and specifically on the ruinous deep declines impacting the long-term.

Betting bookies operate in a different world, yet they utilize similar statistical analysis and relationships. One big difference is betting has a binary outcome; you either win or lose with odds in the bookie’s favor. In contrast, investing can result in more potential outcomes, and… as long as investors stay in the game, the odds are in the investor’s favor. Coupled with unknown peaks and troughs, remaining invested throughout the business cycle is generally the best course of action.

CRN-5470791-021623

Recent Comments