Let’s talk about it. Recently, there’s been much talk about the U.S. dollar being replaced as the world’s reserve currency. Interestingly, the media has chosen to incite as opposed to offering insight. Though it is a complex issue, let’s peel back the layers of the onion.

A college professor taught me nothing is permanent in the long run. Status quo is simply a function of time. This holds true the U.S. dollar as the world’s reserve currency. Ultimately, at some point, something will replace the U.S. dollar… but it’s extremely unlikely any time soon.

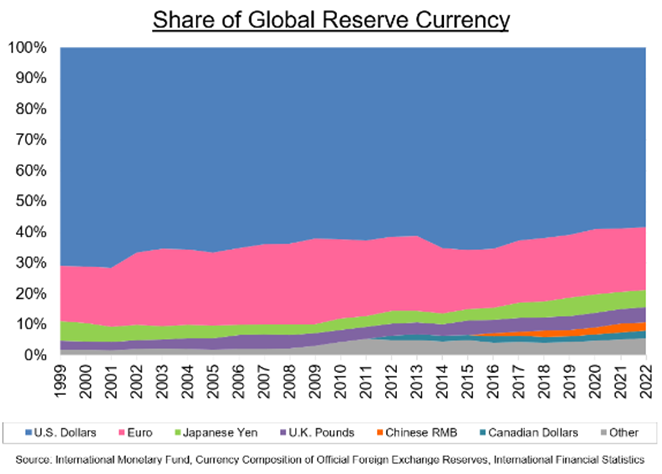

Recent headlines have pointed to the Chinese Yuan (a.k.a. Renminbi or RMB) to take over the top spot. Seems odd as the Yuan has only recently captured a barely noticeable weight of currency reserves (See the orange sliver on the chart), which just surpassed the vaunted Canadian Dollar’s representation. The lion’s share of reserves is the U.S. dollar (58%) followed by the Euro (20%), the Japanese Yen (5.5%) and the U.K. Pound (5%)1. It doesn’t seem reasonable for a 2.5% currency weight to take the top spot in the short-term.

Being the reserve currency is more than being pronounced as such via edict. The world has accepted the U.S. Dollar as the world’s reserve currency based on the weight of the U.S. economy (The U.S. economy is currently about 25% of the world’s economy with second place China being about 17%1.); its economic flexibility; it default-free longevity; free-market ideals; transparency; durability through economic, social and miliary challenges as well as its military backing. In other words, the U.S. Dollar has earned international trust.

The debate to replace the U.S. Dollar is not new. The 1980s saw similar arguments with the rise of the Japanese Yen. Additionally, the Euro was introduced as a consolidated European currency in part to challenge the U.S. Dollar.

This is not to say the U.S. Dollar’s deterioration has marched on unnoticed. The U.S. Dollar’s share has experienced a slight steady decline since 1999. (The chart commences with the start of the Euro in 1999.) But this is likely due to economic growth outside the U.S., reducing the relative weighting of the U.S. economy and utilization of “other” currencies (grey area on chart). The Euro has seen similar share deterioration, especially after the Greek Default/Credit Crisis which endangered the Euro’s existence.

It would be delict not to recognize China’s economic and military ambitions. The bigger picture is China’s incremental moves to become a world superpower, which requires miliary and economic strength. Recent international deals agreed to Yuan denominated transactions emboldens China’s economic offensive.

The U.S. Dollar will eventually be replaced by something, but that something has to have the economic heft, historical durability and worldwide trust. At this point, there is nothing on the horizon. Incredulous attempts by the media to suggest different is only there to stoke readership and spur ad dollars.

1 International Monetary Fund

CRN-5637681-042023

Recent Comments