Phil’s ex-wife, Phyllis, claims Phil is a compulsive liar! February 3, 2023 (Groundhog Day), at Gobbler’s Knob, PA, Punxsutawney Phil exited his burrow predicting six more weeks of winter. For the Mid-Atlantic, Midwest and Southern states, the arrival of sprouting trees1 have proved Phil’s prediction wrong. Apparently, Punxsutawney Phil accuracy is only 39%2. Maybe Phyllis is correct.

Unlike Punxsutawney Phil, some economic data exhibit near-clockwork seasonal accuracy. Most notably is housing data. For several reasons, housing data, such as home listing and home sales, follow the same path each and every year. Monitoring these data may offer insight into the housing market and can act as a canary-in-the-coal-mine for broader economic impacts.

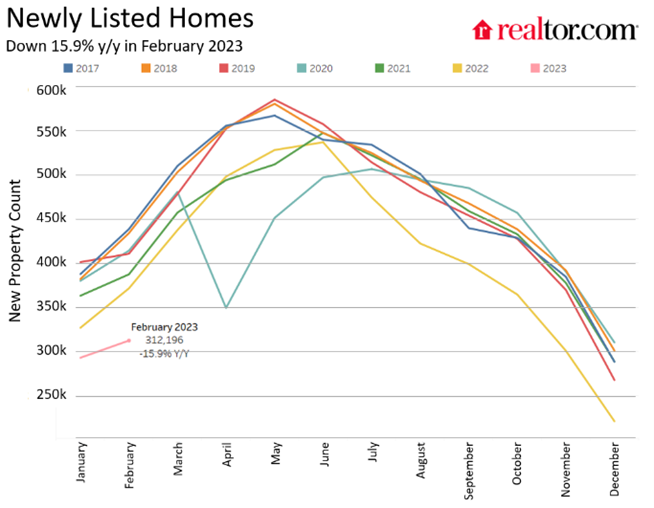

For all intents and purposes, March is the leading edge of housing market. Home listings increase as colder days disappear and sellers announce intentions to move on. Given the typical four-to-eight-week viewing/negotiation/inspection/settlement process, listings peak in May and taper offer through the rest of the year as summer ends and school commences. This pattern has only been interrupted in 2020 by COVID.

So far in 2023, the housing market is off to a tough start. Listings, being the first step, are significantly off previous years. Housing is extremely sensitive to interest rates. This should make intuitive sense as the vast majority of home purchases require borrowed money, hence more expensive money translates to fewer buyers as well as home price reductions. Apprehensive to accept lower prices, potential sellers accept their status quo and are less willing to list one’s home. Should the early muted trends continue, which is highly likely due to higher interest rates, 2023 national housing market may be lack luster market, admittedly local dynamics may differ.

More broadly, weak housing trickles to downstream industries. Fewer home sales translate to lower demand for moving services, home improvement contractors, appliance purchases, furnishings, etc. Lower demand for all of these goods and services has a disinflationary effect (being sought after by the Federal Reserve for the past 12 months), but if slowed too much, subdued downstream demand could contribute to recessionary pressures. Over the past few weeks, the push and pull of these outcomes have spurred debate of a hard-landing, soft-landing or no-landing. Latter 2022 data pointed to a hard landing (recession), yet more recent data has given markets to wrestle with a no-landing (no recession) scenario, though likely overly optimistic. Conflicting data are a sign of the times; some indicating recession is upon us, while other showing a resilient economy. On net, economic weakness seems to be the path we are on.

Data absent groundhog weather predictions may not be the wisest course of action. Following the data seems to be more prudent, so the data we will follow.

1 https://www.wsj.com/articles/cherry-blossom-trees-record-early-spring-7484812c

2http://www.stormfax.com/ghogday.htm

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. Forward looking statements may be subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

CRN-5505518-031023

Recent Comments