When uncertainty enters the fray, it takes discipline not to become unraveled. That’s what happened this week. However, the stock market has an impressive track record of overcoming almost insurmountable odds.

The worst decline of 2022 happened on Tuesday, as the August’s inflation release was higher than expected. The difference didn’t seem like much on the surface, but the elevated inflation proved there was more work for the Federal Reserve to do. This means continued vigilance and higher interest rates to break the back of inflation.

The report was not all-bad. Inflation has been heading down since the peak in June. Hence, we are on the right path. Energy, travel and recreation categories showed falling prices. However, these were not enough to stamp out inflation that has spread to other sectors. Therein lies the financial markets’ concerns. Not only did inflation deceleration fall short of expectations, but the inflation problem also broadened to more areas of the economy.

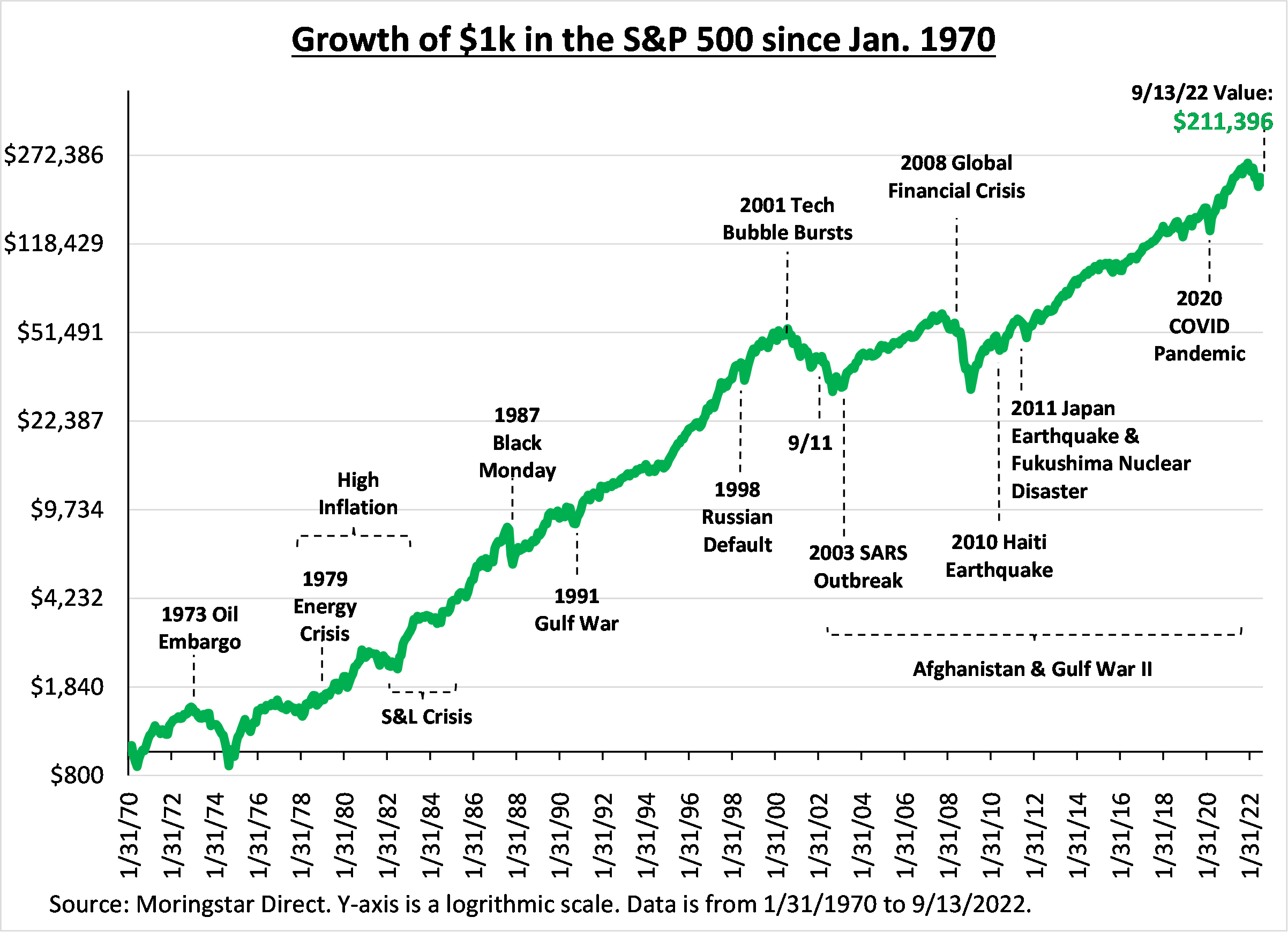

At the end of Tuesday, the S&P 500 closed at 39331. Although down from the beginning of the year, the S&P 500 was in the same vicinity 18 months ago (3943 on 3/12/21)1. Not to mention, the index was clearly higher than 3, 5, 10, 20 or 30 years ago. Over the years, there are always issues, conflicts, or worries that could give pause to investing. Interestingly, had those anxieties taken hold, investors would have missed significant appreciation. Over the long-term, the stock market has overcome many different types of challenges.

During one of the worst times in economic history, not too far in the past (the 2008 Global Credit Crisis), Warren Buffett, the sage of Omaha, was quoted saying, “Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.” The Dow closed on Tuesday September 13th at 31,1052, or about 170% from the 11,497 Buffet quoted.

It’s almost impossible to ignore the barrage of headlines that’ll have you second guessing your investment decisions. So, if you do find yourself getting preoccupied with short-term worries, make sure to also remember the stock market’s long-term history of triumphs.

1finance.yahoo.com

2https://www.nytimes.com/2008/10/17/opinion/17buffett.html

CRN-4956512-091922

Recent Comments