“Everyone has a plan…

until they get hit.”

-Mike Tyson

Whoever thought boxing legend was a philosopher?!? But what is true in the ring also resonates for life and the financial markets. The unexpected hit of Silicon Valley Bank’s (SVB) collapse sent shutters through the financial markets. Last Friday bore the brunt of the decline with convulsions throughout Monday as news of a second bank, Signature Bank, collapsed on Sunday.

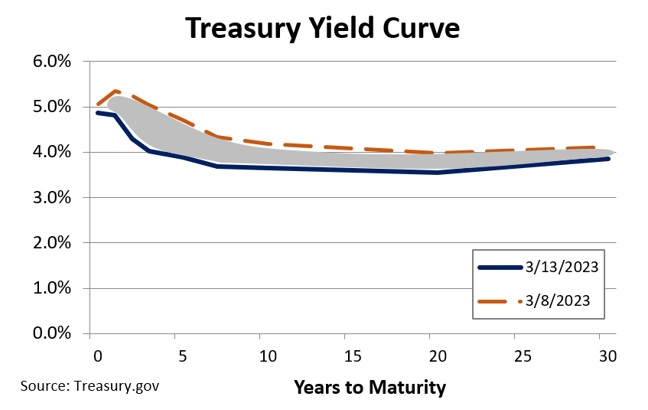

Ironically, the failures came on the heels of Federal Reserve Chairman Powell’s semiannual report to the Senate and House banking and finance committees. Powell informed Congress (and by extension, the public) interest rates would need to reaccelerate to fight inflation, a departure from earlier comments. The unexpected hike mention was the initial right-hand jab for the week, setting up for the left hook, the SVB failure.

So, what happened with SVB? In short, SVB was subject to a liquidity squeeze. Banks profit from the difference from what they make on loans or bonds and what they pay depositors. Deposits are known as “demand deposits” because deposits can be demanded at any time. At the same time, the loans can’t be called or sold as easily. If too many depositors request too much of their money back, it can cause a run-on-the-bank where the bank can’t satisfy all withdrawal requests, hence a collapse.

SVB offered banking services, which included deposit accounts and loans, primarily to technology startups. Peter Thiel’s Founders Fund and other venture capital funds requested return of their deposits beyond the SVB’s reserves1. SVB unsuccessfully attempted to sell bonds/loans and raising cash to satisfy the demands, causing the collapse1. In a similar fashion, Signature Bank was a central player in funded cryptocurrency banking. What do these have in common? Both were running fast and lose. Play with fire, you’re bound to get burned.

At first glance, SVB and Signature situations seem to be isolated incidents. But, after broader reflection, aggressive lending to speculative areas, unprecedented rate hikes and excessive fiscal support contributed to these failures. These economic cracks should be a warning to the Fed going forward.

At the end of the day, current financial markets are concerned about two things: 1) interest rates, and 2) recession, with the former garnering most of the immediate attention. The SVB collapse left the markets reeling in confusion, with notable players (such as, Goldman Sachs) making an about face calling for a pause to rate increases2. Wrestling with the hike/no-hike debate led to a roller coaster ride on Monday and a subsequent upswing as markets accepted a 0.25% at the next Fed meeting, followed by a pause. This is a major departure from expectations just a few days prior of a total of 1.00% in future hikes.

There is a lot happening in the world of finance which we watch and will keep you posted as they unfold.

2 https://news.yahoo.com/fed-bets-pared-goldman-scraps-031122728.html

The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp.

CRN-5521648-032023

Recent Comments