Diversification… a term often used to communicate asset allocation policy, or portfolio asset class weightings. Diversification has been the primary tenant of portfolio design and construction for decades. Diversification rarely comes to mind when thinking of time. What does diversification have to do with the passage of time? How can things be spread over time?

Diversification… a term often used to communicate asset allocation policy, or portfolio asset class weightings. Diversification has been the primary tenant of portfolio design and construction for decades. Diversification rarely comes to mind when thinking of time. What does diversification have to do with the passage of time? How can things be spread over time?

Time diversification does not imply time travel. You may have to speak to an astrophysicist about the space-time continuum if that is your interest. Time diversification within an investment context deals with investing assets to meet objectives throughout time. More specifically, investing assets appropriately to maximize return potential while minimizing risk for said period.

Time diversification is as important as asset allocation. In fact, it may be more important than asset allocation. The wealth management industry often looks to a client’s risk tolerance to determine an appropriate portfolio. A client’s risk tolerance helps define psychological pain thresholds but defining an investment period offers better context for portfolios. For example, should a client need money in six months for a car, stocks and even most bonds would not be an appropriate option. Yet, for the 25-year-old investing for retirement cash would a poor choice and stocks would be very appropriate. What is the governing criteria? Time.

Compartmentalizing goals, as in the above examples, is not always practical or known. Yet, wealth-based portfolios understand and recognize the importance of allocating assets across time to attain an appropriate risk/return tradeoff. This often means overlapping a client’s financial plan’s cash flow model with capital market assumptions while being aware of markets’ historic norms and a client’s risk tolerance.

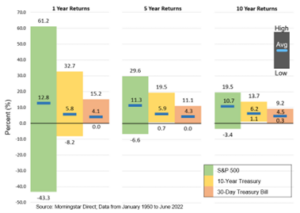

Stocks, in particular, tend to have rather consistent average annual returns approximating 10%. Yet, the near-term annual swings can be rather dramatic. Bonds and cash tend to have menial returns yet offer lessened annual volatility making them better suited for near-term needs. Stock investing is typically implemented when a long investment horizon (at least 5 years) is required. In the vast majority of cases, people tend to have objectives and goals that last beyond 5 years, even for the 85-year-old retiree, although riskier assets would likely be constrained to a minimum in such a case.

During normal stock market pullbacks, we naturally become defensive and eschew long-term goals. Investing requires psychological tolerance as well as time diversification for an appropriate level of risk to achieve higher long-term returns.

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index. Past performance is no guarantee of future results. The opinions expressed are those of Heritage Financial and not necessarily those of Lincoln Financial Advisors Corp. Asset allocation won’t guarantee a profit or ensure against a loss but may help reduce risk and volatility in your portfolio. Diversification cannot eliminate the risk of investment.

CRN-4891117-080822

Recent Comments