There’s been a lot of provocative talk about the U.S. Debt Ceiling. It may be worth more rational thinking to overcome the some of the emotionally charged articles being written of late.

What is the Debt Ceiling?

More accurately named the Debt Limit, the Debt Limit was enacted by Congress in 1917 to set an arbitrary maximum of outstanding Federal debt, much like a credit card limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit1, similar to your credit card company raising your limit. Of note, the Federal Debt Limit is set by the Representatives spending Federal dollars, so raising the debt limit is akin to a person allowing oneself to spend more.

Why set a Debt Limit?

In short, the Debt Limit is a way to instill fiscal responsibility. As the Debt Limit approaches, it forces Congressional Representatives to conduct serious conversations about the spending priorities.

What could happen if a Congress doesn’t reach a Debt Ceiling agreement in time?

This is where many articles run astray by citing the possibility without citing the probability. Many articles accurately state this could result in a U.S. default yet fail to mention the U.S. has never defaulted, even in light of last-minute negotiations. At the end of the day, Congress takes the 14th Amendment very seriously which states, “the validity of the public debt…should not be questioned.”2

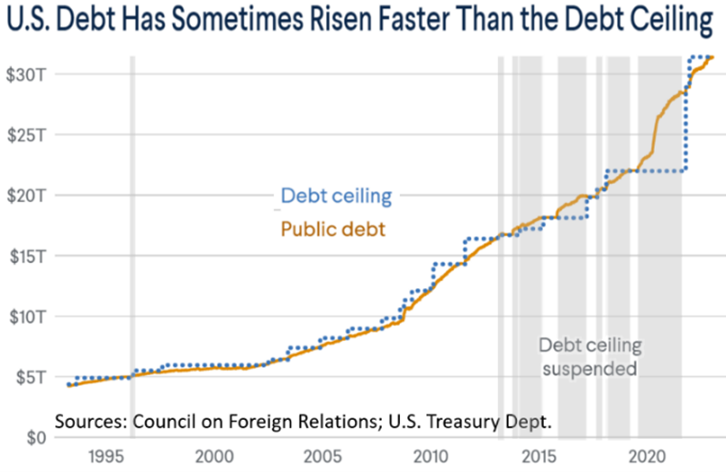

Additionally, Congress has the power to suspend, raise, change or even abolish the Debt Limit. Historically, Congress has suspended the Debt Limit requirements should negotiations move beyond the “X Date”, or the date when a breached Debt Limit would cause a technical default, so a default does not occur, and the government continues operation. In fact, there have been a number of times the Debt Limit has been breached without a default due to the power to suspend(see chart).

Further, the U.S. Treasury can and has enacted extraordinary measures to help fund the U.S. government and its obligations through a negation period. The extraordinary measures often mean prioritizing payments until Congress acts. Janet Yellen, Secretary of the Treasury, undertook extraordinary measures on January 19th.1

In closing, the Debt Limit is a self-imposed guardrail which can be altered, suspended and abolished. The Debt Limit is in place to force spending priority negotiations. Congressional Representatives have a good understanding of a U.S. default impact on global financial markets. Lastly, the U.S. has the power to print its own currency, meaning it can simply create money to pay obligations. This last point brings on long-term concerns of its own, but near-term obligation payments can be handled. Always be a little leery of the media’s sensationalism.

1US Treasury, https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit

2https://constitution.congress.gov/constitution/amendment-14/

CRN-5449348-020323

Recent Comments