This summer, the stock market experienced notable volatility, reflecting a complex interplay of economic, geopolitical, and financial factors. The period was characterized by significant fluctuations, driven by investor concerns about a range of issues, including inflation, interest rates, and global economic conditions.

One of the primary sources of volatility was the ongoing debate over inflation and its impact on monetary policy. After a period of relatively high inflation, central banks, particularly the Federal Reserve, faced the challenge of balancing interest rate hikes to curb inflation without stifling economic growth. The uncertainty around how aggressively these rate hikes would be implemented created significant market swings. Investors grappled with the potential for both an economic slowdown and the possibility of higher borrowing costs impacting corporate profits and consumer spending.

Geopolitical tensions also contributed to market volatility. Ongoing conflicts and uncertainties in various regions, such as the continued strain in U.S.-China relations and geopolitical unrest in Europe, added layers of risk to the market. These tensions not only affected investor sentiment but also had broader implications for global supply chains and economic stability.

Moreover, the performance of major tech stocks, which have been a driving force in recent years’ market movements, exhibited substantial fluctuations. Issues such as regulatory scrutiny, earnings reports, and changing consumer behavior led to sharp swings in tech sector valuations, influencing overall market sentiment.

Economic indicators, such as employment data and consumer spending reports, further complicated the market landscape. Mixed signals from these indicators made it challenging for investors to gauge the health of the economy and predict future market trends. For instance, softening employment figures accompanied by stable consumer spending numbers left investors contemplating recession, soft-landing, or no-landing scenarios.

Amidst these factors, investor sentiment played a crucial role. Market participants’ reactions to news and data releases often exacerbated volatility, as sentiment-driven trading led to rapid shifts in asset prices. The combination of high-frequency trading algorithms and speculative trading added another layer of unpredictability to the market.

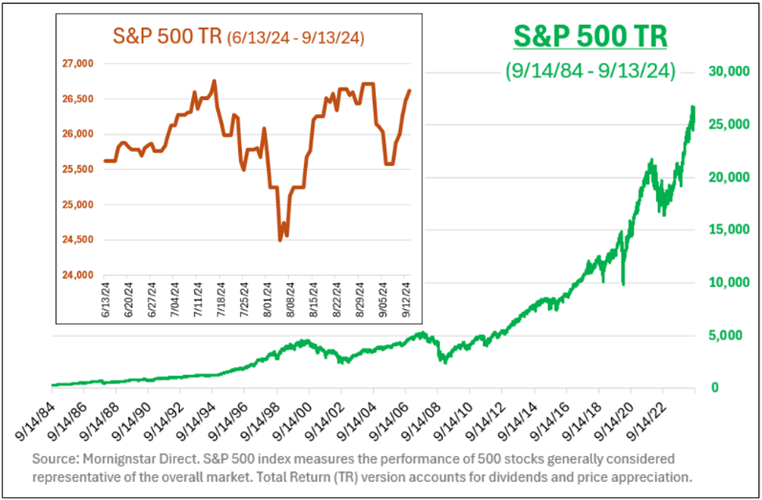

The near-term can often jaundice our expectations of reality. Behavioral finance has termed this “Recency bias.” Recency Bias is our innate tendency to let the recent past alter our perception of long-term reality. Review of the long-term history can help rectify one’s perspective. The accompanying near-term orange chart is just a few data points of the long-term green chart.

Overall, this summer’s stock market volatility highlighted the intricate dynamics of today’s financial environment. It underscored the challenges investors face in navigating a landscape shaped by evolving economic policies, geopolitical uncertainties, and shifting market trends. As always, this period of volatility serves as a reminder of the importance of diversification, risk management, and staying informed to better navigate the complexities of the stock market.

CRN–7027779–091724

Recent Comments