What’s Ahead? After a relaxing Memorial Day weekend, return to insightful reflection is at hand. Financial markets’ future is always opaque as markets attempt to discount risks, yet lessons can be learned from historical study. History may not repeat itself, but it does offer context with general directional expectations.

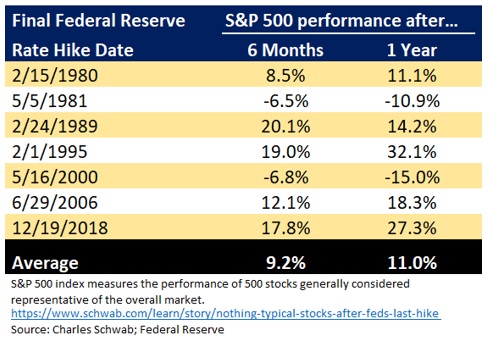

The Federal Reserve (Fed) has indicated a “hawkish [rate hike] pause” as the default presumption. More recently, some Fed voting members have suggested one more rate hike may be needed during the June 14th meeting. Examining financial market returns after the last rate hike seems apropos, specifically evaluating periods commensurate with the Fed’s current interest rate approach. Inflation fighting and inflation consciousness became the primary mindset due to lessons from the 1970s, hence reflection of 1980 thereafter.

Since 1980, there have been seven completed interest rate hike cycles. The average returns after the rate hike summits have produced positive returns for six and 12 months after the last rate hike. All is not perfect as two cycles produced negative returns after the final hike. Though the circumstances, buildup and reactions are unique to each period, the probability is in investors’ favor.

The 1981 summit was followed by purposefully induced recession to conquer high inflation. The buildup to this rate summit was the Fed’s misguided “stop-go” monetary policy. The “stop-go” policy started in the 1960s. The “stop-go” policy altered between high inflation and high unemployment. The mindset was high employment and low inflation couldn’t coexist, later proven incorrect. The “stop-go” policy ultimately caused high long-term inflation and was jettisoned in the early ‘80s. Point being, the “stop-go” policy is a relic of the past and not pertinent to current circumstances.

The 2000 negative returns were a result of the Tech Wreck. The Tech Wreck was preceded by a massive technology buildout due to the internet infancy, Y2K concerns, and Dot-Com company surge. No doubt, this was a very unique period not likely to be repeated, nor relevant to present day.

On a separate note, this week witnessed to a Debt Ceiling agreement between Congress and the President. Our insights are designed to offer a different perspective and context of investment and economic issues often missed in the public domain. A recent newsletter addressed the Debt Ceiling drama and suggested an 11th hour resolution. No, a crystal ball is not our muse, but history and rationale are. We now await the voting process and hopeful the agreement will be concluded prior to June 5th.

Here’s to returning to work, though our efforts never stop. The enjoyment of digesting new information, being aware of pending legislation, and applying situational awareness is part of what gets us up in the morning. As schools prepare to wind down and summer vacations begin to take shape, know that we are here looking out for you.

CRN-5711674-053123

Recent Comments